|

|

|---|

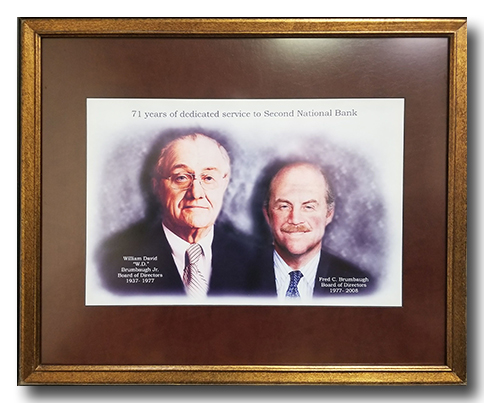

I). First Years. Two years before dad's passing in January 1983, he asked me to replace him on the bank board. (Before that I had tried to persuade David Ault not to go forward with plans to be do the exterior of the bank. What a disaster!). The bank board after the Second World War, was afraid of the Next Great Depression. It made very few loans. Most of his capital was tied up in long-term US government bonds. If then, as later became the banking regulation, the had the mark the asset folio to market price, the bank would have been forced to declare bankruptcy. The bonds were selling at a then current average rate of $0.30 on the dollar. The good news was, family friend, Don Tittle had become board chairman. Bill Blaine dad's Partner at US Chemical , Berk Wooster dad's law partner, Bill Blaine , business partner, Robert Taylor, my first boss, all good friends were on the board. The board had started the process of building a real bank. They were lending money!

I saw the opportunity. Before dad died I was persuade him to agree to allow family trusts to buy more stock from local shareholders. (Our family started with 15% of the stock, and when it was sold in 1999 we owned 60%: the stock had gone from an average price of eight dollars to $$90 . After two years David Ault was hired by the Troy bank, which had just been acquired by the First National Bank of Cincinnati. Don Hittle, found a new president Charlie Brown from Springfield, Ohio. This proved to be a disaster. He stayed for four years, but it took me two years to get the board to agree to get rid of him. Marv became president and the Good Times Began!!

II). Building and Selling: The Banking Years.

A). Expansion. In my first two years, under Don Hittle's direction, we bought Fort Recovery National Bank in Mercer County. Great acquisition. We then open branches in Arcanum Ohio, and Versailles, Ohio. (We later, acquired for zero dollars the Arcanum Savings-And-Loan Association. Bankrupt in the S&L crisis. Beautiful building not much business.) Most importantly the bank became an aggressive agricultural lender. Marvin new agriculture. Don Hittle, and Bill Blaine headed the loan committee. Everyone had total confidence in their judgment. Rarely made a mistake. (It was a wonderful time in that a bank could "stretch the rules" and when to a solid citizen with a weak financial statement, while putting restraints on a citizen with a strong financial statement, but a shady past. That all changed to the detriment of rural banking, as Washington and laws like Dodd-Frank overregulated the industry.) But the most important move was new management.

B). Marvin Stammen. In my second year on the board we bought the bank in Fort Recovery Ohio. The chairman of that bank came on our board. He asked me to go to the small bank convention in Salt Lake City. There I met Marvin. He had grown up on a farm close to Fort Recovery, and next to Mr. Sweeterman's home Cranberry Prairie. Fascinating! I was totally impressed. He was 27 years old working for a bank and Napoleon Ohio. He would commute to his family farm at Cranberry Prairie on the weekends to work the farm. I called him and his bank. I told him I wanted him to move to Greenville, as VP under Charlie Brown. He could take as much time off to farm as he needed. I asked him what salary he would require. He said $27,000 a year. I said done deal,but we have to pay him 29,000. One of the my best deals! Two years later when I was desperate to replace Charlie Brown with Marv, he held me off for nine months saying he was too young. Finally mission accomplished. We built the bank. The bank became, asset wise, the largest financial institution in Darke and Mercer County. From 1990 until the sale, the bank was ranked, in its peer group, in the top 20 in United States, and number one in Ohio. Marv later served to three year terms on the Cleveland regional Federal Reserve Board. Besides working with Marvin, Don, Ray, and certain board members to build the bank, I had many other interesting side lines associated with the bank.. The best of times!

B). SNB Corporation. For financial reasons I had the bank form holding company,the SNB corporation. The holding company wned 100% of the Second National Bank stock. One of the benefits was as Chairman and President I could control the company, but maintain very low profile in Greenville. In the small town, if your bank chairman, everybody wants you to go to dinner, etc. . Don Hittle and later Ray Lear, as chairmen, did a superb job of representing the bank in the community.

C). Park National Bank. By the late 1990s the bank industry became fiercely competitive. Mr. McCoy, as Chairman of City National Bank in Columbus, had successfully lobbied to change the banking laws. (When I worked in Columbus for George Greek King and McMahon, Mr. McCoy was one of our top clients. Our offices were in his bank building. I did some work for him.) For five years banks in Ohio were allowed to acquire other banks in contiguous counties, and then statewide. Large city banks were buying up all the small banks. Two large banks opened small branches in Greenville. We decided to sell. After exploring many opportunities, I traveled with Marvin to at least four banks in Ohio, we found the perfect fit ,Park National Bank of Newark Ohio. Their model was to keep each bank they acquired as a local entity, it's own name and its own team. It's president and chairman, Dan Delauter, joined our bank board. He taught be more about banking and finance and I ever learned at Columbia School of Business, or during my life's pursuit of businesses etc. Became a wonderful friend. Top Ohio banker. R(. I stayed on the board until 2012.).

III). Stories. One of the great benefits of honoring dad's request to go on the board, was the timing was perfect. My life was in disarray and I and depression. It was a great Avenue other than Nelson for me to stay busy, and most of all make so many new friendships. Back in Greenville, many old friends; Dr. Bill Browne, childhood neighbor childhood neighbor, Joanne Swank Lear wonderful North school friend husband to bank board, Jim Goubeaux childhood friend childhood, Harvard lawyer .Had a wonderful girlfriend Darlene. Dayton, Washington ,Baltimore and now Tipp City – Greenville r homes. In addition in representing the bank I had a number of "unusual" encounters..

A) First National Bank of Cincinnati. Before statewide banking, rural banks had to have a major bank as a correspondent. This was special relationship. The major bank would handle current functions with the Federal Reserve in a number of important functions. First National Bank of Cincinnati was our correspondent. It acquired the Troy bank. The chairman of that bank, also the chairman of Hobart Manufacturing, Kitchen Aid of Troy Ohio, was David Meeker. Mr. Meeker grew up in Greenville friend of my father's and worked for grandfather Coppock. He hired our president David Ault , unacceptable practice for regional banks!. He called me and said Freddie would you stop by my office and Troy. I was mad. I did. He said we would like to buy your bank. I said no way. I then offered to buy back his few shares in our bank. He smiled and sold them to me. (Two years later he put me up for the Troy country club membership). I then, went to Cincinnati and met the chairman of the 5th 3thrd Bank, Clem Benger. (His Executive Vice President Beverly Tucker, had been three years behind me in the Ivy club At Princeton). I asked him if he would be our Correspondent bank. He said he was delighted. I then had scheduled a meeting Across town With the chairman of the First National Bank of Cincinnati. They welcomed me "Wonderful to see you Fred, how can we be of help" etc. I said as a matter of fact I am pissed-off!. Your Troy bank stole my bank president totally against the rules. I am Moving our account to the 5th-3thrd Bank. And left. Years later I was in the Bankers Club in Cincinnati at the urinal. Next to be was the First National Bank chairman mentioned above. He said "Fred are you still Pissted off?" I said, certainly am. He then bought me a drink in the bar.Those were the days!

B). Deal Off. The The Chairman of the banking Piqua Ohio, approached me and suggested we merge our banks. I went to my lawyer, he went to his, we came up with a draft of a deal that made sense. Before I could discuss it with my board, he called and said "Deal Off", he continued, saying that he had not realized that after the merger my family would have controlling interest over the combined banks. Surprise! Almost pulled it off.

)B). Jim, and Esther Eiting. A Magic Moment. Marv suggested we put Jim on our board. Jim was the chairman and chief operating officer, next to the American Aggregates of the county's largest business, located in Versailles Ohio. It was called Mid Mark. In the beginning, it manufactured stretchers for ambulances. 10 years before Jim and his group acquired the company from an acquaintance of mine in Winchester Indiana and moved it to Versailles. He had greatly expanded and improved the product line to include, medical stretchers operating tables etc. He had built his own large conference center outside of town. And was beginning to build his own golf course for customers. A few months after joining the board he invited me to his house for dinner. He brought in customers from Germany. I drank a little too much and babbled in German. Thought that was the end of our relationship. He loved it, I soon discovered that his wife Esther, mother was from cranberry Prairie, a cousin of John Spearman! They became, the best of friends! We would go sailing on my Silky in the Chesapeake for week every summer. I would stay at their wonderful home on Lake St. Mary's Ohio. We did so much together all the best of times. To watch Jim built Mid Mark into an international company, factories in California and one in Europe. Improved lines to include that computers for doctors, a line of products for veterinarians. He was a great benefactor of his town. His restaurant, the in and Versailles was the best in the county. He and Marv Stammen were responsible for improving the county airport so it would handle his corporate jet. On and on. Still great friend, Esther died this year.

C). Other Special Friends, Marvin and Millie Stammen, Ray and Joanne later, Bill and Cornelia Browne, On and on wonderful experiences wonderful times.