Prologue VII). BNB. (20 Great Years). |

BNB Founding Offices St. Paul St. Baltimore, MD |

|---|

VII). BNB. (Fun Times!).

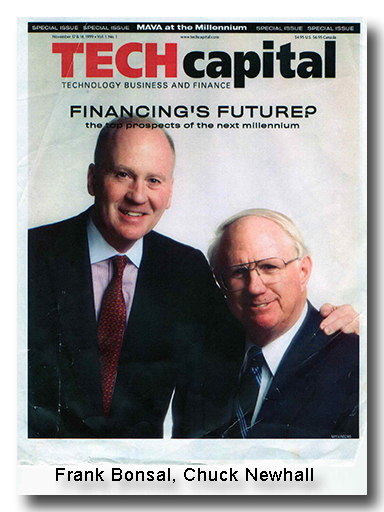

A). Inhabitants. The players. First, Frank Bonsal, who after NEA six partnership formed another of other successful venture firms of which I participated. Secondly Chuck Newhall, to stay on for a number of other partnerships, also after retirement for very successful venture capital firms with his sons. He became chairman of the Baltimore Maryland Art Museum. They all made incredible fortunes. Also, we rented spare space. Howard Wolf, had brought initial money into NEA, had his own investment fund. I was an investor. Today he is the largest former landowner in Baltimore County, with a sizable horse breeding operation. Cub Harvey and I shared an office. He was the former chairman of T.Rowe Price. Cub helped NEA get started. Good friend, he and his wife fixed me up with a number of ladies in Baltimore and Naples Florida. Genius, he rented a room, dear friend of all of ours. Original assistance to T. Rowe Price founder. David Wilmerding, old Philadelphia money. He and two created a sizable fund. Left the building for office North Baltimore. I lost extremely large amount of money with the group. After Frank's last NEA partnership, he and I shared an office on the top floor with Joe Hardeman. He kept the office for over five years. Joe was fantastic. He had been managing partner at Alex Brown years ago, and then was chairman of the NASDAQ. In retirement he and Frank, not Fred, that a lot of deals together. Nancy Dorman was the NEA in-house manager. Great friend made sure I was well taken care of, from dinners to airline reservations. Truly a Second Home.

T.Rowe Price. Cub helped NEA get started. Good friend, he and his wife fixed me up with a number of ladies in Baltimore and Naples Florida. Genius, he rented a room, dear friend of all of ours. Original assistance to T. Rowe Price founder. David Wilmerding, old Philadelphia money. He and two created a sizable fund. Left the building for office North Baltimore. I lost extremely large amount of money with the group. After Frank's last NEA partnership, he and I shared an office on the top floor with Joe Hardeman. He kept the office for over five years. Joe was fantastic. He had been managing partner at Alex Brown years ago, and then was chairman of the NASDAQ. In retirement he and Frank, not Fred, that a lot of deals together. Nancy Dorman was the NEA in-house manager. Great friend made sure I was well taken care of, from dinners to airline reservations. Truly a Second Home.

B). NEA. Fred's " assistance". I was totally flattered that Frank and Chuck were always asked me into meetings where the interviewed potential investments. I would go on the road with Frank or Chuck and look at deals. In the first two partnerships they invested in everything. For example, Frank, Chuck and I interviewed Miss Fields Cookies. Any kind of start up would be interviewed. As NEA progressed past the second partnership it became more specialized. Frank was best at medical companies, Baltimore, and Boston especially. Chuck was managing partner and found financial institutions. Later partner Dick Kramlich, California Silicon Valley. I was always invited to every event and every special meeting. After Frank left NEA grew and grew. Today one of the largest private venture capital firms in the world. Many billions under management

.

C ). BNB. Second Home. In the first couple years it did provide a function of one of the places I lived. I had a bedroom on the top floor. Would stay there a few weekends a month. Because of the relationship with Frank, and my Ivy club friends in Baltimore, in the pre-Sally years. A second real home. I joined the Maryland club. George Beall one of my closest friends had become president of the club . Lunch on Fridays with Frank great group. Spent many wonderful times over the years as Frank's guest in the Green Springs Valley. Baltimore was the Ivy club of the South, close friends, Ed Dunn president of Maryland bank and chairman of John Hopkins Hospital. (Help me when I sold Second National Bank, and son manages money today for family.) Buzzy,Kronguard, later chairman Alex Brown. Also on so many boards, big deal! But still friend. George Beall, who was close friend Baltimore, and in later years Jackson Hole. Father US Sen. brother US Sen. Maryland. George US Attorney that prosecuted VP Spiro Agnew.

D). Free State Investment Club. Frank Bonsal and George Beall, top social Baltimore social standing; arrange for me to join the prestigious financial institution Free State Investment Club. Other good friends, Pokey Frazier, and Jack Kukteweyer were also members.There were only 23 members. Top of the business community. Bart Harvey, then, CEO Alex Brown Investment, his brother President Maryland National Bank. Others included Executive Vice President rRouse and company developers of Columbia Maryland, Chairman and CEO Black & Decker,tool manufacturing company, Vice Chairman another Maryland bank, top ranked corporate lawyer, wealthy Easton Maryland real estate developer, on and on. High jinx! At the first meeting I attended, the chairman, the local bank president, said it now I want to introduce you to our new treasure, then he said "by the way who is our treasure". We meet four times a year drinks fun, great stories. Most of all we took trips to Nassau, to Florida, to Dominican Republic and other ; absolute best of people best of times.